I was just reading the following article on Business Times

- Astro best taken private: Khazanah

Published: 2010/03/31

Astro All Asia Networks Plc, the country's sole pay-TV operator, is best taken private at this stage, says Khazanah Nasional Bhd's managing director Tan Sri Azman Mokhtar.

"(Astro) has better value in being taken off the market with the current stage of development of high definition television (HDTV) and the Indian market," he added.

However, given Astro's substantial shareholder, Usaha Tegas Sdn Bhd's track record, it may relist the unit later, similar to Maxis, he told reporters on the sidelines of Invest Malaysia 2010 in Kuala Lumpur today.

It has been reported that major shareholders, led by tycoon T.Ananda Krishnan, intend to take Astro private in a deal valued at RM8.5 billion.

They believe that privatisation of the company which was listed in October 2003, would optimise its capital structure for local and regional expansion.

It is also understood the company would need to spend between RM3 billion to RM3.5 billion over the next three years, to accelerate its domestic and international growth, including migrating to HDTV.

Meanwhile, Ananda's Usaha Tegas owns 58 per cent of ASTRO Holdings Sdn Bhd, Khazanah 30 per cent and Bumiputra Foundations 12 per cent.

Astro would only be delisted if the major shareholders secure more than 90 per cent of shares from the privatisation exercise. -- Bernama

Ok, I do not understand the statement.

- However, given Astro's substantial shareholder, Usaha Tegas Sdn Bhd's track record, it may relist the unit later, similar to Maxis, he told reporters.

Listing, delist and relist. Again doesn't this make Bursa Malaysia irrelevant?

Then the following statement from him struck me.

- "(Astro) has better value in being taken off the market with the current stage of development of high definition television (HDTV) and the Indian market,"

The Indian market.

Aha!

This reminds me of Aircel!

Flashback the posting: Regarding Aircel and Maxis. It seems that as mentioned in a Business Times article in Nov 2009, Aircel had 26 million subscriber growing at one million new subscriber per month!

That was the jewel in Maxis.

The incredible growth in Aircel.

Which got me asking, what about Astro's growth in India.

Sun Direct TV.

So I asked Google.

http://www.afaqs.com/perl/media/story.html?sid=26440

- As per its website, Sun Direct reaches approximately 5.3 million homes, whereas Tata Sky has a subscriber base of more than 4.5 million and Dish TV has about 6.5 million subscribers.

That article was dated 4th March 2010. Here's a newer one. DTH aims peak subscriber growth in FY'11 on back of sports

- Tata Sky has 16 per cent of the incremental subscriber growth while Sun Direct has 21 per cent and Big TV 12 per cent, the sources add

Sun Direct has 21% subscriber growth?????

And here is from Sun Direct own website. http://www.sundirect.in/media.php

Check this out.

7th July 2008 http://www.sundirect.in/mediaDetails.php?mediaId=2

- Sun Direct TV Pvt. Ltd one of the leading DTH service provider announces the achievement of 1 Million DTH subscribers in 200 days.

The one million subscriber base comes from only 4 southern states i.e. Tamil Nadu, Karnataka, Kerala, Andhra Pradesh and the union territory of Pondicherry.

On the eve of this 1 Million subscriber achievement , Sun Direct has launched 14 add-on packages ranging from as low as Rs. 10/- to Rs. 140/- "Packages to suit every pocket" in a "Pay for what you watch" concept for the very first time in Indian DTH scenario.

1 million subscribers in 200 days! WOW!

8th April 2009. http://www.sundirect.in/mediaDetails.php?mediaId=5

- Another landmark achievement for us is crossing the 3 million mark subscriber base by March 2009, as committed earlier; this achievement qualifies us to be the No 2 service DTH provider. In the coming fiscal year we look forward to occupy the pole position. We have added more customers than any other DTH player in the last one year and in the coming days we will be adding more innovative features, services and channels in our offerings.” Added Mr. D'Silva

From July 2008 to March 2009, Sun Direct went from 1 million subscribers to 3 million subscribers!!

Sep 2009. http://www.sundirect.in/mediaDetails.php?mediaId=7

- Fastest growing DTH player to touch 4 million base in less than two years time

Chennai, 7th September, 2009: Sun Direct Pvt Ltd, the leading direct-to-home (DTH) service provider in the country achieved another milestone by crossing the 4 million subscriber base; the fastest growing player in the DTH market to do so in under two years, since its launch in December 2007.

Setting up a scorching growth pace in the market with its Value for Money offer, right regional content mix, deep distribution across the country and offering flexi-content pricing, all of which have enabled Sun Direct to become the fastest growing DTH player in the country today.

4 million subscribers now!!!!

What incredible growth!

How?

Don't you think Sun Direct is a company with incredible potential?

Then the Maxis saga, the listing, delisting and relisting came to mind.

Hmmm... very much possible, yes? What if Astro delist... goes private.. and relist only the Malaysian operations only. Just like Maxis. Dare we say not possible? The new Astro without Sun Direct! Just like Maxis without Aircel.

I know I am usually wrong, so could I be wrong here?

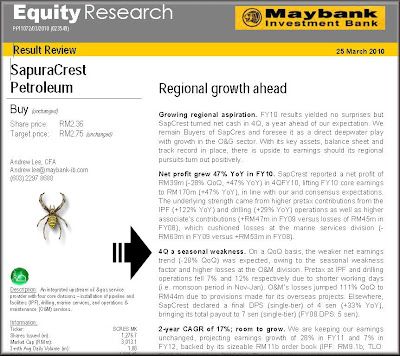

Yeah.. and not to forget, Astro earnings is turning around nicely too!